Google Jumps Despite Missing On Top & Bottom Line Thanks To Stronger Ad Sales

The tech earnings train has gotten derailed and it's looking uglier by the minute: moments after Microsoft slumped after missing on the top and bottom line when the surging dollar led to the slowest sales growth since 2020, and Texas Instruments guided below expectations, it was Google's turn to disappoint and it did just that when it reported earnings that missed on both revenue and EPS, and yet unlike MSFT stock which is tumbling after hours, GOOGL stock is, at least for now, higher in kneejerk response.

Let's dig into what was another mediocre at best (if perhaps not as ugly as some had expected) quarter:

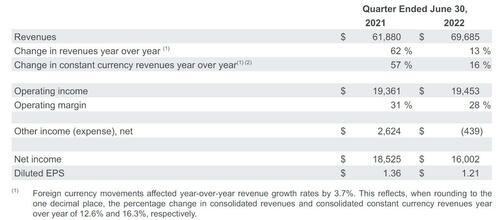

- EPS $1.21, missing the estimate $1.32, down from $1.36 Y/Y

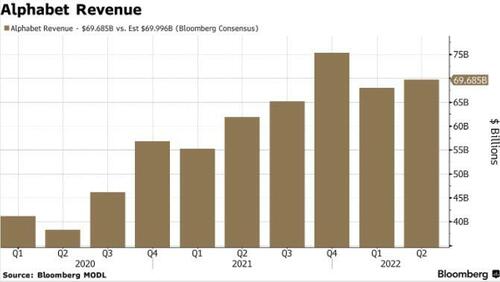

- Revenue $69.69 billion, up 13% Y/Y (vs 62% a year ago) and missing the estimate $70 billion

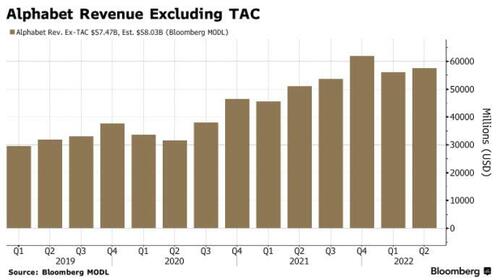

- Revenue ex-TAC $57.47 billion, missing the estimate $58.03 billion (Bloomberg Consensus)

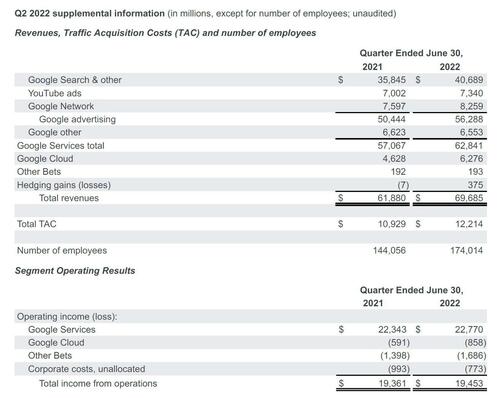

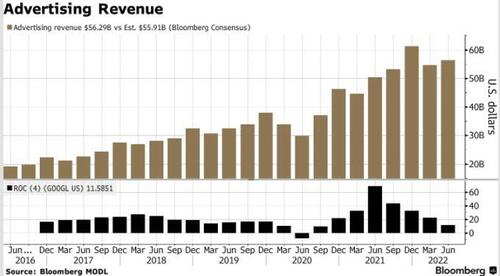

- Google advertising revenue $56.29 billion, beating estimates of $55.91 billion

- Google other revenue $6.55 billion, missing estimates of $7.11 billion

- Google Services revenue $62.84 billion, in line with estimate $62.89 billion

- Google Cloud revenue $6.28 billion, missing estimates $6.32 billion

- Other Bets revenue $193 million, missing estimates $300.4 million (stuff like Waymo, focused on self-driving cars; the health-focused Verily; and startup investments)

- Operating income $19.45 billion, missing estimates $20.33 billion

- Google Services operating income $22.77 billion, missing estimates of $22.91 billion

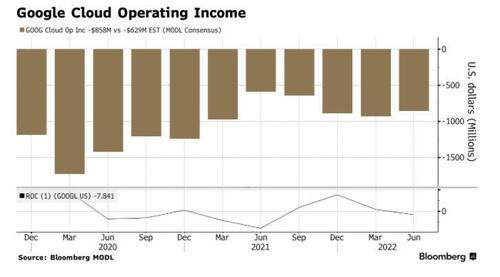

- Google Cloud operating loss $858 million, missing estimates of loss $628.8 million

- Other Bets operating loss $1.69 billion, missing estimates of loss $1.22 billion

- Operating margin 28%, missing estimates 28.4%

- Capital expenditure $6.83 billion, missing estimate $7.99 billion

- Number of employees 174,014, above the estimate of 168,454

The results visually:

And a more detailed breakdown:

Here is revenue:

... and ex-TAC:

There was more bad news: not only did Google’s cloud business fall short of analyst revenue expectations, it and continues to bleed money: The unit reported $858 million in losses during the quarter, up from $591 million in the year-ago quarter.

Commenting on the cloud results, Bloomberg Intelligence said investors are focused on cloud, which continues to be unprofitable for Google: “When you think about Amazon and Microsoft, both of their cloud operations are profitable -- north of 20% operating margins. And it begs the question that if Google is really diversifying, why can’t they do it in a profitable way? It doesn’t show up in the numbers here, and I think that’s where investors are concerned.”

Mercifully, CEO Sundar Pichai kept his comments brief: “Our performance was driven by Search and Cloud.” He also touted the company’s investments in AI and computing."

To the disappointment of some, there were no incremental stock buyback announcements but recall that just last quarter GOOGL announced plans to buy back an additional $70BN in Class A and Class C shares, and also unveiled the 20 for 1 stock split.

That said, Alphabet did repurchase $15bn of stock in the quarter, a sign of GOOGL management continued focus on capital allocation and balancing investments/margins in a post pandemic environment. That may explains why Alphabet’s cash hoard declined for a third straight quarter, falling to $125 billion from $134 billion at the end of the first quarter.

So despite missing on the top and bottom line, the reason why GOOGL shares may be higher after the close is simple: last week's Snap cataclysm put expectations at rock bottom levels. The good news for Alphabet is that as shown below, ad revenues were not battered as much as Snap, and rose 12% from the previous year to $56.3 billion, narrowly surpassing analyst expectations of $55.9 billion.

The reason why Google wasn't as affected by Apple’s privacy changes as other social-media companies like Meta and Snap is that ad-pricing changes on the Android side are in Alphabet’s control. It owns that platform, and YouTube is all brand advertising.

Meanwhile, YouTube’s ad growth was relatively meager, but not as rough as last quarter, a good sign for the video unit that is dealing with the hit from Apple’s ad-targeting ban. CFO Ruth Porat said that despite the hiring slowdown, the company hasn’t changed its investing priorities.

Porat also said Google expects bigger currency headwinds in the third quarter given the movement in the dollar. This has been an issue that impacts the company’s results at the margins, but usually isn’t a huge factor.

So thanks to the relatively solid performance from the company's core advertising business, results missed but were "better than feared" and the stock managed to rise sharply the report, boosting the entire Nasdaq and even helping push Microsoft, which had tumbled, close to turning green.

Looking ahead to the earnings call, investors will focus on any management commentary on the broader macroeconomic environment, the dynamics that YouTube revenues are currently facing, the dynamic of growth and margin (with focus on potential for improved rate of losses) in Google’s Cloud segment and how management is analyzing balancing investments in long-term initiatives in a continued volatile macroeconomic environment.

https://ift.tt/G8XR0uA

from ZeroHedge News https://ift.tt/G8XR0uA

via IFTTT

0 comments

Post a Comment