Stocks, Bonds, Gold, & Cryptos Extend Gains As White House Confirms 'Fed Pivot'

Deese, Biden, and Yellen all proclaimed: "nope" when questioned whether today's consecutive negative GDP print means recession...

...harkening back to jobs data 'we cannot have a recession with such a strong jobs market'. Ironic then that today also saw initial jobless claims weaken to their worst in 8 months...

Source: Bloomberg

Oh, and then there's this...

The strong payrolls report is often cited as evidence that the US economy can't possibly in recession.

— Albert Edwards (@albertedwards99) July 28, 2022

It depends though which 'jobs report' you look at. The Household Survey measure, which is more sensitive to turning points, is certainly ALREADY consistent with recession. https://t.co/087R0Tt4v4

And this...

In mid-70s recession, econmy was in recession frm Nov73 - spring 75. Yet the economy *added* jobs in each of the recession's first nine months. Yes, job growth is an imprtnt indicator but alone, its insufficient to argue against recession. @JimPethokoukis @TonyFratto @IvanTheK pic.twitter.com/mwfENZwecR

— Dan Greenhaus (@DanGreenhaus) July 28, 2022

...ok, and this...

ICYMI: What Do Payrolls Tell Us About The Timing Of The Next Recession?

— zerohedge (@zerohedge) July 28, 2022

The median payroll 10 months before a recession is the same as the final month before a recession with little sign of a trend in the months between!https://t.co/UdZRPehEyo

But hey, we're not biologists, so how would we know if we are in recession or not?

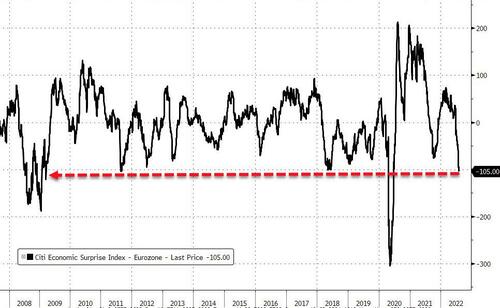

Did anyone notice EU consumer confidence hit a record low today and German inflation unexpectedly re-accelerated today? European macro data is at its weakest (ex COVID lockdowns) since the Great Financial Crisis...

Probably nothing, right? ...won;t drag the US down further, right?

Meanwhile, the Democrats continued to browbeat Powell into being dovish today with Powell throwing The Fed under the bus for "fighting inflation" and slowing the economy and Biden economic advisor Jared Bernstein presumptively closing in an interview with MSNBC claiming that "The Fed's monetary policy pivot is completely appropriate."

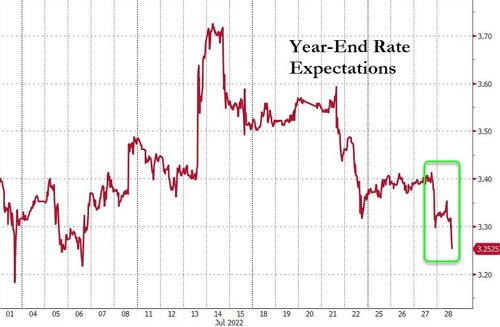

The market has adjusted dovishly, leaving less than 90bps more hikes priced-in for the rest of the year (and a surge in rate-cut expectations after that)...

Source: Bloomberg

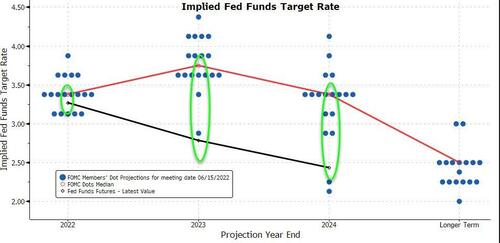

Will Powell push back against that? The market is now massively more dovish than The Fed's last dotplot which Powell specifically called out as worth watching yesterday...

Source: Bloomberg

Well he has a lot of time until J-Hole...

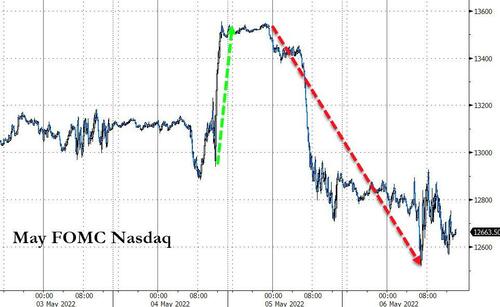

Meanwhile, for a brief moment after the cash equity open, it appeared today was going to mirror the last two FOMC statement market moves with a big surge followed by a bigger puke...

Source: Bloomberg

But that dip was bought aggressively just before Nasdaq erased all post-Fed gains as the FOMO Capitulation we warned of struck hard... The US Majors are all up around 2-3% post-FOMC-statement now...

With S&P seemingly finding strong support at 4,000 once again...

After yesterday's short-squeeze, this morning saw "most shorted" stocks puke back all their gains before a panic bid squeeze re-appared around the European close...

Source: Bloomberg

Stocks were not alone in the buying-panic.

Bonds were aggressively bid (after the recessionary print) with the belly of the curve dramatically outperforming today (2Y -10bps, 5Y -13bps, 30Y -6bps). The long-bond is now unch over the last two days with the 5Y yield down 20bps...

Source: Bloomberg

The 10Y Yield puked to its lowest since mid-April...

Source: Bloomberg

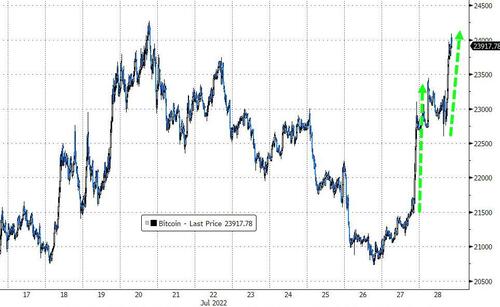

Bitcoin soared back above $24,000...

Source: Bloomberg

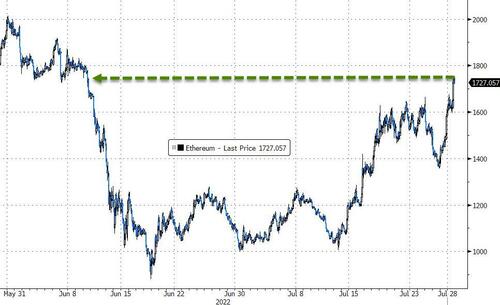

Ethereum soared back above $1700 - its highest since early June...

Source: Bloomberg

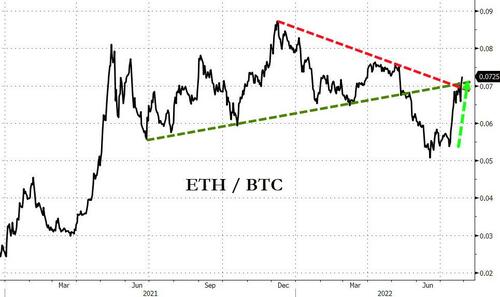

Notably Ethereum has erased all its recent underperformance relative to bitcoin...

Source: Bloomberg

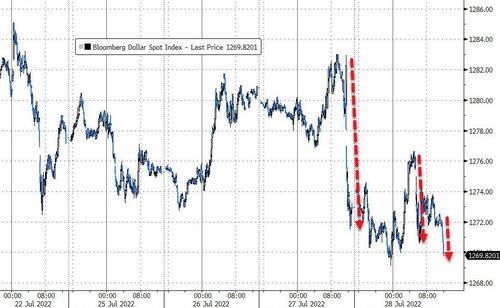

The dollar chopped around today but ended lower, extending yesterday's dovish puke (to its lowest since 7/5)...

Source: Bloomberg

Gold ripped back above $1750...

Oil prices rollercoastered today with WTI ripping up towards $100 before sliding back into the red below $97...

Finally, despite the fact that tomorrow we get The Fed's traditional favorite inflation indicator (PCE Deflator) and The Fed's most recent favorite inflation indicator (UMich inflation expectations), hedges were abandoned today with VIX dropping to a 22 handle...

Has this squeeze and 'over-hedged' unwind run its course?

And one more thing - who gives a flying fuck if the word 'recession' is being used - Americans' (Adjusted) Misery Index is at its worst level since Jimmy Carter was president...

Source: Bloomberg

And if everything was so 'not recession'-like - why would consumer sentiment and presidential approval ratings be at record lows?

https://ift.tt/BWer7Jd

from ZeroHedge News https://ift.tt/BWer7Jd

via IFTTT

0 comments

Post a Comment