The 'Wile E. Coyote' Economy & The Long-Duration Stock Fallacy

Authored by Peter Tchir via Academy Securities,

Tricky markets at best, and seemingly futile markets at worst.

The danger for me is that rapidly shifting correlations make many hedging and almost all relative value trades difficult to maintain. Those shifts in correlations tend to be problematic for taking risk and may go a long way in explaining why the short baskets outperformed so much.

Anecdotally, I am extremely concerned that we ended the week with many, if not all, hedges having been removed. It is difficult to get a short squeeze, much less support, if there are few shorts left!

Recession Risk

I am clearly in the camp that the recession risk is closer than we think and that it will be deeper and more painful than the market is currently pricing in. Speaking in front of a thousand or so people at the SFA Vegas conference, I had the opportunity to give my Wile E. Coyote scenario, where the economy, much to the surprise of everyone, hits a wall.

Data has been mixed in terms of supporting my theory. Though I continue to see far too much “straight line extrapolation” and too little “inflection” point analysis for my taste, as I do think that “this time is different” and not in a good way, for reasons laid out in several recent T-Reports.

At the SFA conference, one of the big consumer data providers indicated that they were seeing upticks in delinquencies and that is ahead of many borrowers having to potentially start paying back student loans and other debt that had been placed in moratorium.

Housing data has been generally weak to awful.

Finally, on Friday, the market was hit with Eurozone Manufacturing and Composite PMI coming in below 50 (contraction). Even more disturbing was the huge miss in US Services and Composite PMI, with the composite coming in at 47.5 versus projections of 52.4. For a “service” economy, that is a big miss and I don’t think it can be explained by the strong dollar or some of the other issues that have been plaguing the market.

Sure, inflation played a part (even though gasoline prices eased recently), but I’m concerned that contractions like this will rapidly shift the employment outlook and I cannot say often enough (in my opinion) that politicians will remember that job losses and recessions are even worse for re-election than inflation (though I’m not sure why they forgot that, or maybe they are just in “the recession is going to be after the election” camp, so who cares?)

In any case, we are still left with answering two questions:

-

Is the recession risk closer than previously thought?

-

Is pricing in a recession going to be good or bad for stocks?

-

Rates should grind lower if we are hitting an economic speedbump, but will that help or hurt stocks? (I owe some lines on the “long duration” stock fallacy).

-

Which almost brings us to the Fed this week, but first, let’s do a quick pitstop on earnings.

Earnings

So far earnings have not stopped the market from going higher. There were enough good earnings to offset bad earnings. Many of the companies were not projecting too many concerns about the future (or at least the market seemed to think so last week). The one company that did attract my attention was SNAP, which was down almost 40% on Friday after they released earnings. That had a sort of “oh #&^#$” moment feel as it was reminiscent of some of the earnings reactions we saw last quarter. Hopefully, we don’t get an onslaught of those types of reactions again, but Friday at least puts that fear back into play.

The Fed

75 bps.

-

Canada going 100 bps gave the Fed a chance to indicate they would go 100 before their quiet period started, but they steered towards 75 bps.

-

Europe going with 50 bps opens the door for the Fed to do more, but I’ve seen nothing reported that indicates that behind the scenes the Fed is pushing the market towards more than 75 bps.

-

Commodity prices have generally rolled over and there has been some weak economic data (like the PMIs), but with the high CPI print too fresh in everyone’s mind, it is difficult to see the Fed hiking only 50 bps.

So, I’m in the 75 bps camp (very consensus).

Will they do anything about “quantitative tightening”? There has been some chatter that the Fed may signal that they will be cautious on balance sheet reduction.

-

On the one hand, even last summer, the Fed mentioned market liquidity as a reason to continue with QE and market liquidity is far worse now than it was then (I still can’t believe even T-bills are experiencing a lack of liquidity).

-

On the other hand, it would be an admission that QE and QT do not work in practice the way many thought they do in theory. QT was supposed to “steepen” yield curves. Not so much. QE does not affect asset prices directly. Sure, and I’ve got a bridge in Brooklyn.

I think the Fed sticks with QT because they have to and cannot be seen to be backing down on this.

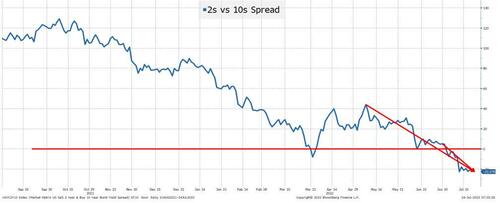

This chart shows that QT is not helping steepen the yield curve. My view remains that QE and QT act like Newton’s Cradle and the action is mainly seen at the extremes as investors of all stripes get shifted in or out the risk spectrum.

There is a lot more going on in the Treasury market than saying that the 2s vs 10s is pricing in a recession, but that seems to be part of it.

Data dependent. The recent signs of economic activity slowing down (and that many commodity prices have dropped) provide the Fed every reason to drive home the fact that they remain data dependent. That will lower rate hike expectations, especially if we get any more doozies like the PMI data on Friday.

For the Fed:

-

75 bps (consensus and priced in).

-

No tamping down on QT (negative for markets, but mostly priced in).

-

Data dependency and no set path for rate hikes (positive for markets, but mostly priced in).

A week ago, we were probably set up to rally on almost anything the Fed did, but that now seems largely priced in.

The Long Duration Stock Fallacy

For much of the past decade and certainly during COVID and stimulus, we had a market that would bid up anything with potential future cash flows.

- Lower yields meant higher stock prices. So long as yields were lower, you could pay more for future cash flows

I think two things have changed:

1. Lower yields are no longer being created “artificially” due to easy money. Yields are going lower because of fears of a slowdown. If yields are going down in fear of a slowdown, analysts should be revising down future growth projections for the companies. If yields were moving independent of future growth, then it was logical to bid up those potential future cash flows when yields went lower. But logically, if yields are going lower due to economic concerns, we should be reducing expected future cash flows, making this former “no brainer” trade far less simple.

2. There is now a potential path dependency for companies that did not exist even a few months ago. Cash was readily available for any company, even those burning through cash. It was almost as though burning through cash was “good” because it showed growth (of some sort) and meant that the next series of money could be raised sooner at an increased valuation. What if that easy game is gone and some companies may not make it through this downturn and pullback in financial conditions? In the past, the thought was maybe you could ignore downturns because every company could survive those to reach their full future potential, but now the worry is some might not. Some might have to be cautious about growth, conserve some cash today, and push the growth projections down the road. This is a change that I think is meaningful.

So, that is my basic premise on the fallacy. Lower rates cannot automatically lead to higher valuations because business plan delays will impact growth projections.

Bottom Line

I still like Treasuries.

I think credit should do well, though I’d be cautious on lower quality leverage loans, but would, ironically, be loading up on senior tranches of CLO’s (it isn’t as counterintuitive as it seems on the surface).

On equities, I’m more bearish again, but need to be in very small positions until we see what the Fed does. I expect that we need the Fed to hammer home data dependency (code for less hiking) to really rally, but I’m just not sure the Fed is there yet.

Stay out of the heat, read a good book, don’t light hundred-dollar bills on fire (if you can at all help it), and hopefully we get more clarity on the Fed.

I do hope I’m wrong on the economy, but I can’t get the Road Runner’s “beep beep” out of my head!

https://ift.tt/poVr8bk

from ZeroHedge News https://ift.tt/poVr8bk

via IFTTT

0 comments

Post a Comment