Watch: Fed Chair Powell Desperately Avoid Saying The 'R-Word'

With The White House and its cadre of "economists" proclaiming that there's no recession... and if there is it's The Fed's fault... we look forward to hearing Fed Chair Powell explain how the most aggressive Fed hikes in decades to crush inflation through the demand side of the economy will not - by definition - cause a recession, just a "softening" (sorry we said the 'r'-word).

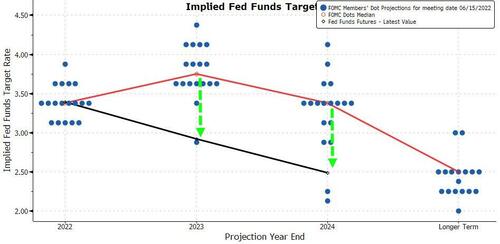

Crucially, all ears will on Powell's ability to jawbone the STIRs market away from the the rate-cuts priced in for Q1 2023 and the recession that this implies (all dramatically more dovish than The Fed's dotplot).

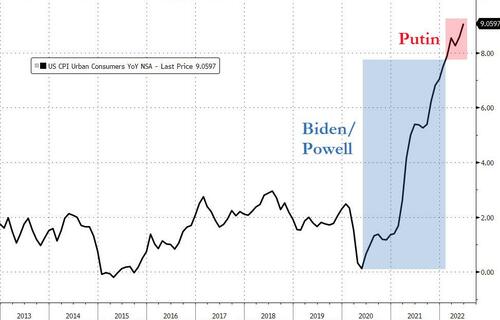

The Fed showed its political UN-independence by blaming inflation of Russia's invasion of Ukraine - will any reporter have the balls to ask about the soaring inflation before Putin did the deed?

Bloomberg Intelligence Chief US Rates Strategist Ira Jersey says:

“Powell has a difficult balance act to contend with today as inflation, though probably in the process of peaking, will remain well above the Fed’s comfort zone. Given the Fed has never stopped hiking until the real Fed Funds rate was positive, more hikes than currently priced are very possible -- maybe to Bloomberg Economics call of 5%. This would mean additional yield curve inversion as the market prices for additional hikes and deeper cuts.”

Additionally, Goldman's John Flood notes that:

"I personally am not expecting any real surprises and am preparing for 75bp hike paired with language that reiterates inflation is inappropriately high but acknowledgment there are some green shoots of moderation in core readings while underlying economic activity remains resilient. Greater probability we get the “less hawkish tone” @ 9/21 meeting (maybe he even hints at this during Jackson Hole Address on 8/26 if July’s jobs report and CPI data that will hit in early August behave). If we get an outright acknowledgment of slowing activity data institutional equities investors (who are underexposed) would be caught offsides and forced to aggressively cover shorts."

The bottom line is that the market has dragged forward The Fed Pivot - the question is, will Powell push back against that, or not?

Watch Live (due to start at 1430ET):

https://ift.tt/mk9p0hZ

from ZeroHedge News https://ift.tt/mk9p0hZ

via IFTTT

0 comments

Post a Comment