The Fall Of Gasoline Demand Has Been Grossly Exaggerated

Gas prices soar -> demand falls.

Gas prices tumble -> demand rebounds.

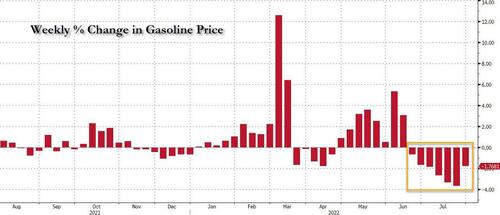

Basic econ, right? Sure enough, we have now seen 7 consecutive weeks of declining gas prices - the longest stretch since the covid crash - and with a gallon of gas down almost a dollar from its all time high just north of $5 at the end of June to 4.27 currently, one would expect hat gasoline demand is once again rising.

One would be right: as Bloomberg notes, falling pump prices are starting to entice drivers back to America’s roadways after what was recently seen as a steep decline in motorists to start the summer.

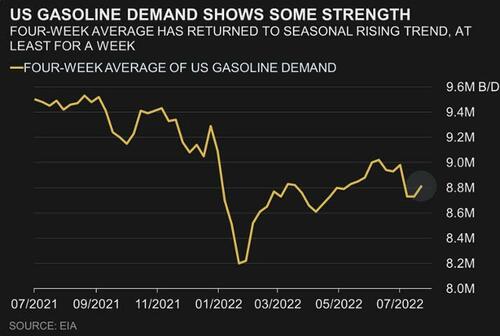

As shown in the next chart, gasoline demand jumped by 8.5% for the week ended July 22 after spending the first half of of the month below 2020 levels for the same period, the latest EIA data show. That came as retail prices posted their biggest weekly drop since 2008, according to auto club AAA.

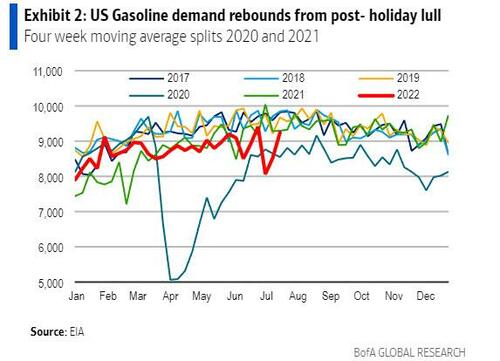

But taking a step back, did gasoline demand really fall in the past few weeks, or is that just an artifact of some faulty model? Well, according to an eponymously titled note from BofA energy strategist Doug Legate (available to pro subs in the usual place), the "fall of gasoline demand appears grossly exaggerated."

As Legate writes, "the narrative around collapsing demand in response to high gasoline prices amidst recessionary concerns is too perfect a scenario on too fast of a timeline to not demand some examination."

Clearly eager to perform said "examination," Legate then notes that this week we finally got the post July 4th rebound we suggested could follow the 4th of July holiday. "For the week ending July 22nd, implied gasoline demand rebounded to 9.2 million b/d - a 1 million b/d increase vs the last two week average, and the second highest level of 2022."

This is important because on a four-week moving average basis, the trend line has resumed higher. And while demand remains below 2019, that is the trade-off between a post-COVID recovery and some inevitable sensitivity to high gasoline prices - albeit well off recent peak summer highs.

As such the BofA strategist concludes that he sees "concerns over some inevitable demand collapse akin to 2008/09 as significantly over done - but mainly from the supply side noting some 1mmbpd of refining capacity shuttered in the US increasing domestic dependency on imports that we continue to believe support above normal crack spreads for US refiner anchored on European natural gas prices: with Dutch TTF now >$60 / MMBTU or >$50 / MMBTU above US Henry Hub benchmarks US refiners have a cost advantage of ~$15/bbl, which on the current forward curve holds through the end of the year."

The bottom line, according to Legate is that evidence of material demand destruction that was somehow confirmed by the last two weeks EIA data, is not obvious - at least not at the depths suggested by the data.

That gasoline demand in particular has rebounded this week, the strategist concludes, "leads us to suggest 'rumors of the death of gasoline have been greatly exaggerated'. With refining earnings due to kick off with VLO and PBF on July 28th, we will get the first glimpse of demand trends from the proverbial coal face - and a refining margin outlook that we see structurally reset by an advantaged US cost of supply and US refining closures - not transitory or seasonal gasoline demand trends."

https://ift.tt/tJQrERK

from ZeroHedge News https://ift.tt/tJQrERK

via IFTTT

0 comments

Post a Comment